Rethinking Cryptoeconomics - Part 3: A Post-Capitalist Critique of Blockchain Scaling Solutions

Aligning blockchain's future with post-capitalist ideals.

The current cryptoeconomic paradigm, grounded in capitalist profit maximization, has significantly influenced the development of blockchain scaling solutions.

In the context of a post-capitalist perspective, drawing from principles found in libertarian left theory and practice, past and present—such as solidarity, self-management, equity, diversity, and direct-democracy—we'll critically assess three prominent scaling solutions—sharding, optimistic rollups, and zk-roll-ups as well as rollup sequencer components—to examine how their design and implementation align with or challenge post-capitalist values and incentives.

Below is our balance sheet accounting for the tradeoffs between these different approaches.

Sharding: Incentives and Trade-offs

Sharding, by dividing a blockchain into smaller segments, theoretically allows for increased transaction throughput. This scalability can incentivize broader adoption of blockchain technology in various sectors due to improved efficiency.

However, the trade-off comes in the form of potential centralization risks. In a shard-based system, nodes or validators with more resources could dominate certain shards, leading to an unequal distribution of power.

This is antithetical to blockchain's foundational principle of decentralization. Furthermore, sharding could inadvertently create an environment where smaller participants, lacking the resources to compete, are marginalized. This disparity goes against the post-capitalist ethos of equitable resource distribution and inclusivity.

Positive Aspects:

Scalability: Sharding aims to enhance scalability by partitioning the blockchain into smaller, manageable, segments.

Reduced Resource Requirements: By distributing the load across shards, sharding can potentially reduce the computational and energy costs associated with transaction validation.

Concerns from a Post-Capitalist Perspective:

Centralization Risks: Shard validators could accumulate disproportionate influence or resources.

Inequality in Participation: Depending on the design, sharding may favor well-capitalized entities, potentially excluding smaller participants.

Introducing Rollups: Layer 1 and Layer 2 in Blockchain

A Layer 1 (L1) is the base layer of a blockchain network. In the case of Ethereum, Layer 1 refers to the Ethereum mainnet itself. It is responsible for maintaining the network's security, decentralization, and consensus mechanism. However, Layer 1 can often be limited in terms of scalability, leading to high transaction fees and slower processing times during peak usage.

Layer 2 (L2) rollups are built on top of the Layer 1 blockchain to address scalability issues. They process transactions off the main chain (Layer 1) and later reconcile them with Layer 1 by depositing funds into an smart contract on L1, thus reducing the load on Layer 1. This helps in increasing transaction throughput and reducing fees.

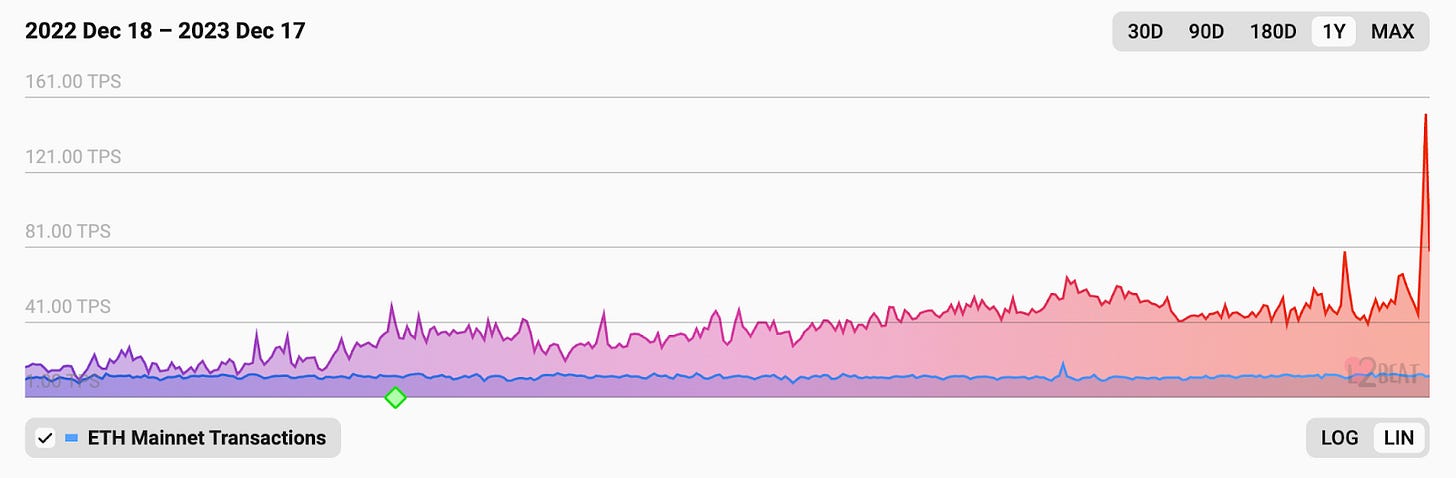

L2s are referred to as rollups because they enable batching of transactions to scale mass transaction throughput. This can be seen in the L2 Beat graph below which measures transactions per second (TPS) on L1 and L2 chains over a 12 month period from December 2022 to December 2023. The blue line represents the Ethereum L1, averaging about 12 TPS. The red line represents the L2 rollup ecosystem over the same period, averaging 50 TPS, with a meteoric rise to 150 TPS in December this year.

Optimistic Rollups: Navigating Efficiency and Equity

Optimistic rollups enhance throughput by executing transactions off-chain and subsequently posting them to the main blockchain. This technique significantly reduces the load on the main chain, improving efficiency and potentially lowering transaction costs. The economic incentive here is clear: higher transaction throughput and lower costs can attract more users and applications to the blockchain.

However, optimistic rollups remain a “trusted” approach. This is because the reliance on the assumption that participants will act honestly (hence 'optimistic'), with the generation of fraud proofs only during challenger periods where suspected fraud occurs, might not fully account for the full spectrum of human behaviors, especially in a system primarily incentivized by profit.

Moreover, the centralization of optimistic validators poses a significant dilemma. If a few economically powerful entities dominate these roles, it can lead to a concentration of power, counteracting the blockchain's decentralized ethos. This centralization could also result in a system that is less resilient to attacks or manipulation, as the power to validate and process transactions is held by a few.

Positive Aspects:

Throughput Improvement: Optimistic rollups aim to increase transaction throughput by moving most transaction processing off-chain, minimizing the load on the main blockchain.

Reduced Costs: By relying on off-chain computation, optimistic rollups can potentially reduce the cost of transaction processing, making blockchain interactions more economically feasible.

Concerns from a Post-Capitalist Perspective:

Reliance on Optimism: Optimistic rollups depend on the assumption that participants will act honestly, and disputes will be infrequent. This optimistic outlook may not align with post-capitalist values that emphasize resilience against malicious behavior.

Centralization of Optimistic Validators: The selection and behavior of optimistic validators could introduce centralization concerns, as economically powerful entities may dominate this role.

zk-Roll-ups: Balancing Complexity with Accessibility

zk-Roll-ups are notable for their ability to offer enhanced privacy and scalability, using complex cryptographic proofs that allow transaction validation without revealing transaction details. This feature is particularly appealing for applications requiring high levels of confidentiality, providing a strong incentive for its adoption in sectors like finance and healthcare. They are considered a “trustless” scaling solution because they generate validity proofs for every state change in the blockchain such that every transaction has been verified against the history of the ledger.

However, the complexity of zk-roll-ups might limit their accessibility. The requirement for specialized knowledge to understand and implement these cryptographic techniques can create a barrier to entry, potentially leading to a concentration of expertise among a few entities. This goes against the post-capitalist value of democratizing technology access.

Additionally, while zk-roll-ups offer privacy, the lack of understanding of the underlying technology by average users could lead to unintended privacy compromises, highlighting the need for balancing technical sophistication with user education and inclusivity.

Positive Aspects:

Enhanced Privacy: zk-Roll-ups provide strong privacy guarantees, as transaction details are not disclosed on the main blockchain.

Scalability: Similar to optimistic rollups, zk-roll-ups aim to improve scalability by moving most transaction processing off-chain.

Concerns from a Post-Capitalist Perspective:

Complexity and Accessibility: Implementing zk-roll-ups involves complex cryptographic concepts, potentially limiting accessibility and widening the knowledge gap between participants. This could result in a technocratic concentration of expertise and resources.

Privacy Trade-offs: While zk-roll-ups offer enhanced privacy, the underlying cryptographic techniques might not be fully understood by all participants, potentially leading to unintended privacy trade-offs.

Centralized Sequencers: Efficiency vs. Decentralization

Layer 2 sequencers are a crucial component in the Layer 2 scaling solutions for blockchain networks, particularly Ethereum. Their primary role is to enhance the scalability and efficiency of the network while maintaining security and decentralization, to an extent. Their primary responsibilities include:

Transaction Ordering: Sequencers take transactions from users and order them before they are processed. This ordering is crucial because it determines the state of the Layer 2 chain at any given moment.

Batching Transactions: One of the key ways L2 solutions achieve scalability is through batching multiple transactions together. Sequencers collect a number of transactions, batch them into a single package, and then submit this package to the Layer 1 blockchain. This reduces the number of individual transactions that need to be processed on Layer 1, thereby saving on transaction fees and improving efficiency.

Maintaining Security and Integrity: Even though they process transactions off-chain, sequencers must ensure the integrity and security of these transactions. They need to correctly apply the rules of the Layer 2 protocol and ensure that all transactions are valid and finalized according to the protocol.

L2 sequencers are integral to the functioning of Layer 2 scaling solutions, offering a balance between scalability and efficiency while trying to maintain the security and decentralization principles of blockchain technology.

However, the design and implementation of sequencers must be carefully managed to mitigate risks associated with centralization and security. Centralized sequencers in Layer 2 protocols, such as Arbitrum, Optimism, Binance’s L2 and many others, offer a solution for increasing transaction throughput while reducing costs.

This model is economically incentivized by the promise of scalability and efficiency, appealing to businesses and applications requiring high transaction volumes. For instance, Coinbase's Layer 2 Base Chain demonstrates the profitability of this approach through substantial revenue generation from sequencer fees. Since launching its Layer 2 Base chain in 2022, “Coinbase has earned $2 million in revenue from sequencer fees, and assuming it retains this level of activity, Coinbase would earn over $120 million annually.”

However, this focus on efficiency and profitability raises significant post-capitalist concerns. Centralized sequencers, by their very nature, go against the decentralization principle, creating points of control and potential failure within the blockchain ecosystem.

This centralization can lead to risks such as censorship, manipulation, or even systemic failure if these central points are compromised. The post-capitalist critique here implies a need for decentralized alternatives that prioritize community-driven values and equitable participation over pure efficiency and profit.

Positive Aspects:

Convenience and Ease of Use: Centralized sequencers are often favored for their cost-effectiveness and efficiency, providing a quick and convenient solution for transaction processing.

Efficiency in Scaling: Layer 2 protocols, seeking scalability and reduced transaction costs, often employ centralized sequencers to batch and process transactions more efficiently.

Concerns from a Post-Capitalist Perspective:

Centralization Risks: Dependence on centralized sequencers introduces centralization risks, as these entities gain control over the transaction processing layer, challenging the principles of decentralization.

Exclusive Fee Models: Centralized sequencer fees may create financial barriers, favoring well-capitalized entities and potentially excluding smaller participants, contradicting post-capitalist ideals of inclusivity.

Maximal Extractable Value: Sequencer operators have the ability to reorder and sensor transactions.

Central Points of Failure: So long as sequences are not decentralized, a bug or error in one sequencer could shut down the whole Layer 2 network.

Moving Forward: Reconciling Technological Efficiency with Post-Capitalist Values

In summary, while current blockchain scaling solutions like sharding, optimistic rollups, and zk-roll-ups bring significant improvements in efficiency and scalability, they often do so at the expense of decentralization and inclusivity. The centralized sequencer model, despite its economic benefits, further exacerbates these issues. A post-capitalist approach to blockchain technology would require a paradigm shift, focusing on solutions that balance technical efficiency with the equitable distribution of power and resources.

As we look towards the future of blockchain technology, it is crucial to develop and adopt scaling solutions that not only address technical challenges but also align with the principles of a socio-economic system that prioritizes collective well-being and equitable access. This involves a careful consideration of the incentives and trade-offs inherent in each scaling solution, ensuring that the evolution of blockchain technology remains true to its foundational ethos of decentralization, transparency, and inclusivity.

delegat0x is a libertarian anti-capitalist R&D Engineer in the crypto space. They write about the intersections between philosophy, politics, media, alternatives to capitalism, social movements, and collective autonomy.